Title loan bankruptcy implications include car repossession and severe long-term credit damage due to high-interest rates and short terms, trapping borrowers in debt. Filing for bankruptcy hampers future loans and hinders financial goals like homeownership. Proactive steps include responsible borrowing, timely payments, and building an emergency fund to restore financial health and avoid bankruptcy risk.

“Title loan bankruptcy implications can significantly damage your long-term credit, affecting future loans and financial opportunities. This article delves into the intricacies of the title loan bankruptcy process, highlighting how it differs from other forms of debt relief. We explore the contrast between short-term relief and the ensuing long-term credit impact. Furthermore, practical strategies are provided to mitigate damage after bankruptcy, offering a path towards rebuilding your financial standing.”

- Understanding Title Loan Bankruptcy Process

- Short-Term Relief vs Long-Term Credit Impact

- Strategies to Mitigate Damage After Bankruptcy

Understanding Title Loan Bankruptcy Process

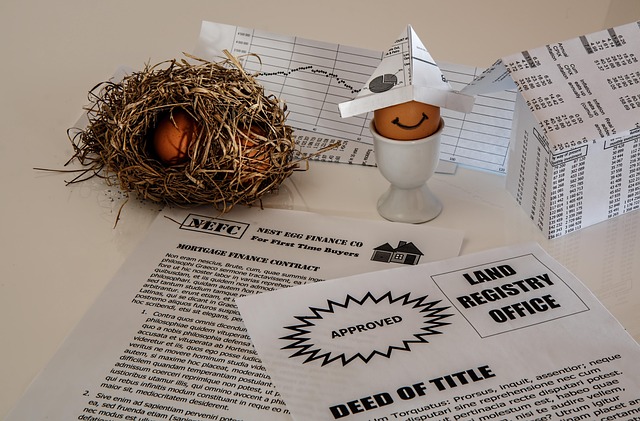

When it comes to understanding Title Loan Bankruptcy Implications, the first step is grasping the process itself. Title loan bankruptcy occurs when an individual or business is unable to repay their title loan, leading to legal action by the lender. This typically involves filing a petition in court, declaring insolvency, and proposing a repayment plan or liquidation of assets to settle debts. The key difference compared to traditional bankruptcies is that title loans are secured by the borrower’s vehicle equity, making the car itself a potential loss for non-payment.

This process has significant Title Loan Bankruptcy Implications, primarily impacting long-term credit. The bankruptcy filing will remain on an individual’s credit report for years, severely damaging their credit score and future borrowing capabilities. Moreover, failing to repay a title loan can result in the lender repossessing the vehicle, eliminating any flexibility offered by the Online Application’s promised flexible payments. This scenario underscores the importance of thorough financial planning when considering such short-term lending options.

Short-Term Relief vs Long-Term Credit Impact

Title loan bankruptcy implications can seem like a quick fix for those facing financial strain, offering short-term relief from overwhelming debts. However, the long-term consequences can significantly damage an individual’s credit standing and future borrowing capabilities. Unlike traditional loans with structured repayment plans, boat title loans or other vehicle ownership financing options often come with high-interest rates and shorter loan terms, exacerbating the problem when borrowers are unable to repay on time.

This short-sighted approach to debt resolution can have lasting effects. While a borrower might regain temporary financial stability, the underlying credit issues remain unresolved. Filing for bankruptcy due to title loan obligations can result in a severe hit to one’s FICO score, making it more challenging to secure future loans with favorable interest rates or even purchase a home. Moreover, it affects future loan terms, as lenders may require higher down payments or charge premium rates for extended periods, impacting long-term financial goals and recovery prospects.

Strategies to Mitigate Damage After Bankruptcy

After experiencing title loan bankruptcy, individuals can take proactive steps to restore their financial health and mitigate long-term credit damage. One crucial strategy is to focus on rebuilding credit through responsible borrowing practices. This might involve securing secured loans or credit cards with a small initial limit, ensuring timely payments, and maintaining low balances. Demonstrating consistent repayment behavior over time can significantly improve one’s credit score.

Additionally, creating an emergency fund is vital to avoid future financial crises. Setting aside a portion of income each month for unforeseen expenses provides a safety net, eliminating the need for high-interest title loans. This approach not only helps in managing cash flow but also fosters financial stability and independence, ultimately reducing the likelihood of bankruptcy.

Title loan bankruptcy implications can significantly damage your credit for years to come. While these loans may offer quick cash, the long-term effects of defaulting can lead to restricted access to future financing and higher interest rates. However, there are strategies to mitigate this damage after bankruptcy. By understanding the process, recognizing the extent of the impact, and employing recovery tactics like rebuilding credit responsibly, individuals can work towards a more stable financial future.